Among the files made public by the House Oversight Committee is a document that stands out for its tone: a glossy 238-page scrapbook that offers a rare and unusually intimate glimpse of Jeffrey Epstein’s self-curated network.

The infamous ‘birthday book,’ compiled by Ghislaine Maxwell in 2003, for Epstein’s 50th includes what appears to be notes from former President Bill Clinton, Alan Dershowitz, as well as photographs that juxtapose girlfriends, animals, children’s drawings with financiers and politicians — a tableau that feels all the more unsettling today.

Maxwell wrote to Epstein at the beginning of the book that she wanted to ‘gather stories and old photographs to jog your memory about places, people and different events.’ She hoped he would ‘derive as much pleasure from looking through it’ as she did assembling it for him.

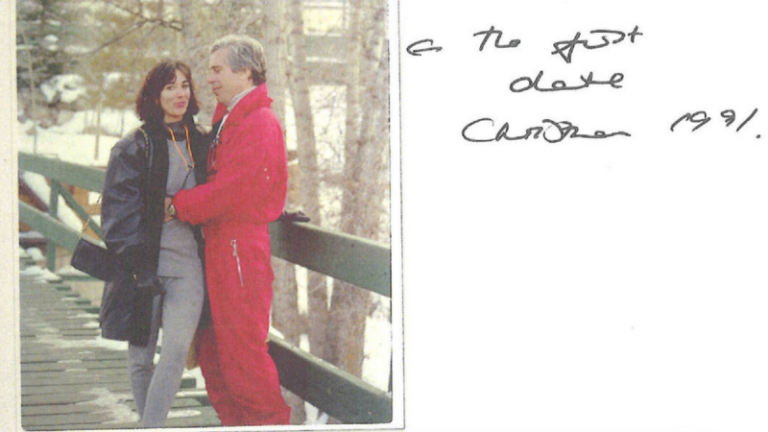

Later in the book, a photo of the two canoodling appears with a caption that reads ‘the first date,’ marked with the year 1991.

Maxwell was found guilty in 2021 of sex trafficking and other offenses, and is serving a 20-year prison term. Prosecutors said she played a central role in Epstein’s scheme, luring underage girls into what began as massages and escalated into sexual abuse.

Now 63 and incarcerated since her 2020 arrest, Maxwell told Deputy Attorney General Todd Blanche in late August that she had no role in the sexual exploitation of minors. When asked about the ‘birthday book,’ she told Blanche that she could only remember some parts of it, adding that it had been years since she compiled it.

Among the book’s entries is an apparent note from Bill Clinton, where the former Democratic president praises Epstein’s ‘childlike curiosity’ and his ‘drive to make a difference’ as well as the ‘[illegible] of friends.’

Dershowitz, a former Harvard University law professor who once represented Epstein during criminal investigations, used his birthday note to make a joke about influencing media coverage.

‘Dear Jeffrey, as a birthday gift to you, I managed to obtain an early version of the Vanity Unfair article. I talked them into changing the focus from you to Bill Clinton, as you will see from the enclosed excerpt. Happy birthday and best regards,’ the entry said.

Dershowitz has repeatedly denied wrongdoing as it relates to Epstein.

The birthday book also contained sentimental messages from family and friends. In one note, Epstein’s mother, Pauline Stolofsky Epstein, wrote that she’s been ‘very busy reminiscing since Ghislaine asked me to write about you.’

‘Jeff[,] you have been a good son since day one and we have been proud of you ever since,’ Epstein’s mother said.

‘I recall you refused to sleep [as a child] unless I read a story from Grandma’s Golden Book that she bought for 25c,’ she added. ‘At PTA meetings I begged your teachers to improve your handwriting.’

She also referenced Epstein’s life as a bachelor, as well as his prominent media shout-outs.

‘At age 27 Cosmopolitan magazine featured you as ‘Bachelor of the Month,” Pauline Epstein wrote. ‘Today you still hold that title.’

‘Jeff, I’m so sorry that Dad can’t share the nachus [pride] we have regarding your achievements,’ she added. ‘He would have been overjoyed reading the article about you in New York Magazine.’

The book features hundreds of photos from throughout Epstein’s life until age 50, including pictures of him as a child and a teenager.

Some of the earlier images included family pictures, formal school photos and pictures of him hanging out with friends as a teenager.

The book also had revealing images of Epstein shirtless, Epstein embracing women and what appears to be a censored photo of him and Maxwell laughing and embracing in a pool. Pictures of mating lions and zebras were also included in the book.

A picture of a woman in a bikini was also included with the caption, ‘Visiting you down in Palm Beach. Can’t get a second of privacy with you and a camera around ha ha!’

Upon the files’ release, Rep. James Comer, R-Ky., chair of the House Oversight Committee, accused Democrats of previously ‘cherry-picking’ the documents.

‘Oversight Committee Republicans are focused on running a thorough investigation to bring transparency and accountability for survivors of Epstein’s heinous crimes and the American people,’ Comer said.