The House Oversight Committee has released another tranche of files related to Jeffrey Epstein on Monday night, which includes a message from former President Bill Clinton in the late pedophile’s infamous ‘birthday book.’

The surprise document dump by the GOP-led panel came hours after Epstein’s estate turned materials over to House investigators, pursuant to a congressional subpoena.

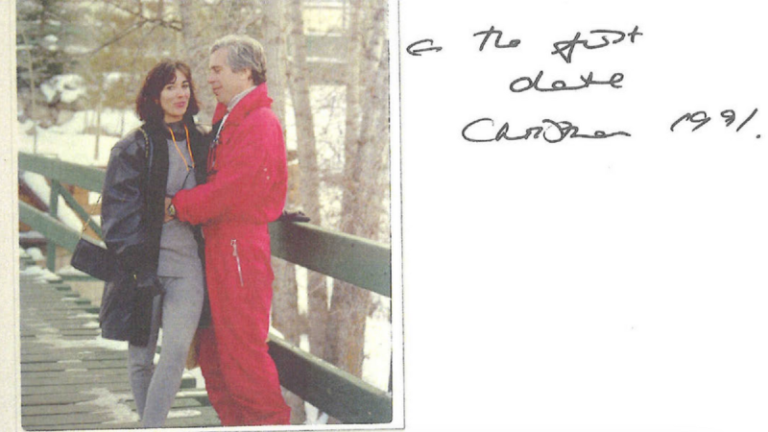

Among the documents released by the committee is the reported book compiled by Epstein accomplice Ghislaine Maxwell for the late pedophile’s 50th birthday.

What appears to be an entry by Clinton praises Epstein’s ‘childlike curiosity, the drive to make a difference, and the [illegible] of friends.’

The book also appears to include entries by former Epstein attorney Alan Dershowitz and President Donald Trump, though the White House and the president himself have vehemently denied its veracity on multiple occasions.

‘As I have said all along, it’s very clear President Trump did not draw this picture, and he did not sign it. President Trump’s legal team will continue to aggressively pursue litigation,’ White House press secretary Karoline Leavitt wrote on X, specifically in reference to a Wall Street Journal story that first mentioned allegations of Trump writing in the book.

Fox News Digital also reached out to Clinton’s office for comment.

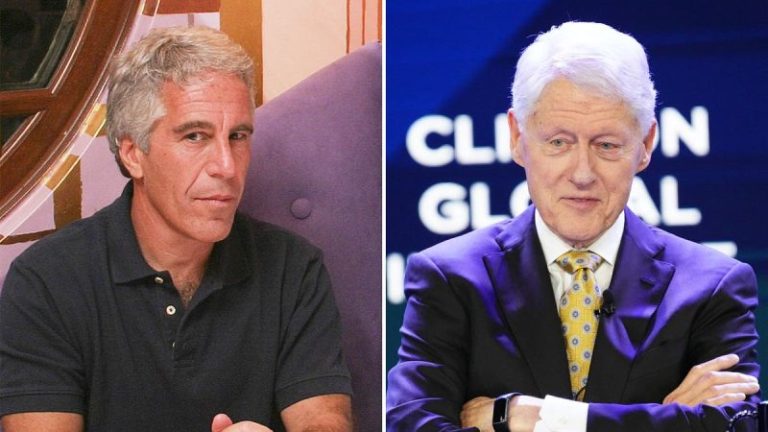

Epstein and Clinton were known to have a cordial relationship, and Clinton is known to have flown on Epstein’s plane on numerous occasions.

Neither he nor Trump have been accused of any wrongdoing related to Epstein, however.

Speaker Mike Johnson, R-La., told reporters when asked about Trump’s entry in the book, ‘I’m told that it’s fake.’

The entry under Dershowitz’s name references a news article that he took for influencing, perhaps in a joking manner, changing the focus from Epstein to Clinton.

‘Dear Jeffrey, As a birthday gift to you, I managed to obtain an early version of the Vanity Unfair article. I talked them into changing the focus from you to Bill Clinton, as you will see from the enclosed excerpt. Happy birthday and best regards,’ the entry said.

Dershowitz has also consistently denied wrongdoing as it relates to Epstein.

A cartoon drawn underneath, that was not attributed to anyone, shows a man at a bar with the caption, ‘I’ve come to the conclusion that I should be thinking less about money and more about naked women, and biomathematical research.’

Other entries in the ‘birthday book’ appear to be Epstein during various stages of his life.

Another entry appeared to make a joke about Epstein being a U.S. intelligence asset. Below a photo of Epstein next to a woman with her face redacted reads a note, ‘He is the boyfriend of [redacted]…We think he works for the CIA.’

A photo on another page shows a young Epstein in front of what appears to be a store counter, with the accompanying caption, ‘Are you sure this will make my ‘winkie’ grow?’

The tranche of documents released by the House Oversight Committee also includes details of Epstein’s last will and testament, what appears to be an address book of contacts, and details of his 2007-2008 non-prosecution agreement with the U.S. Attorney’s Office in Southern Florida.

In a statement upon the files’ release, House Oversight Committee Chairman James Comer, R-Ky., criticized Democrats for earlier releasing only the portion of the files that included Trump’s name – and asserted that the president was not implicated in any wrongdoing.

‘It’s appalling Democrats on the Oversight Committee are cherry-picking documents and politicizing information received from the Epstein Estate today. Oversight Committee Republicans are focused on running a thorough investigation to bring transparency and accountability for survivors of Epstein’s heinous crimes and the American people,’ Comer said.

‘President Trump is not accused of any wrongdoing and Democrats are ignoring the new information the Committee received today. The Committee will pursue additional Epstein bank records based on this new information. Democrats must decide if their priority is justice for the survivors or politics.’

The release comes a day before former Obama administration Attorney General Loretta Lynch is set to appear before Comer’s panel for a closed-door deposition on Epstein.