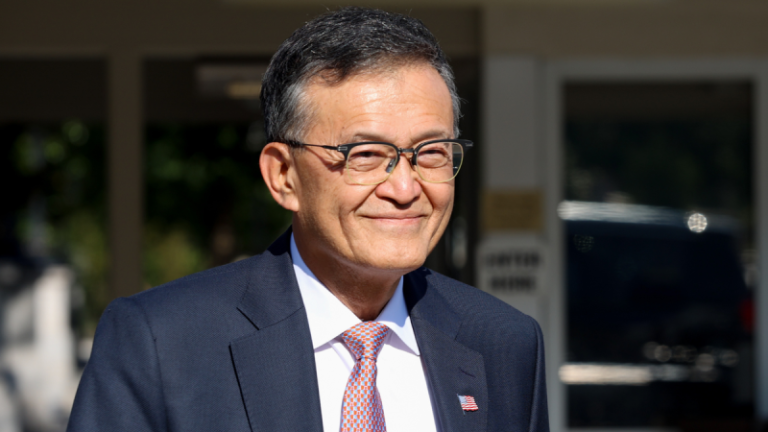

Speaker Mike Johnson, R-La., is hitting the road this week to promote President Donald Trump’s ‘big, beautiful bill’ to Americans across the country.

Among his first stops was Tennessee’s iconic Nashville Palace, where he spoke with employees about the massive GOP agenda bill’s provisions eliminating taxes on tipped and overtime wages.

‘We’re so glad to see y’all. We’re here to talk about the no tax on tips provision,’ Johnson said in a video obtained exclusively by Fox News Digital. ‘You know what this means, at the end of the day, everybody has more money in their pockets and less money they’ve got to send to Washington.’

The footage also shows Nashville Palace general manager Cole noting that his staff were ‘happier.’

‘Everybody’s a little more happy when they make a little more money,’ Cole said.

Johnson also spoke directly with workers Vince and Shelby at the event, with Shelby telling the speaker she was ‘really happy to hear’ about the new tax provisions.

‘We think the numbers for Tennessee are pretty extraordinary,’ Johnson replied, noting ‘there’s a lot of tipped workers in Music City.’

Bartender Vince noted that eliminating taxes on tips would make his life ‘easier,’ later noting that it would give him a chance to travel and worry less about money.

It comes as Republicans have launched a full-court press tour promoting Trump’s agenda bill, even as Democrats attempt to wield it as a political cudgel ahead of the 2026 midterm elections.

Critics of the bill have positioned it as a tax giveaway for wealthy Americans at the expense of vulnerable Americans, citing provisions including new heightened work requirements for certain people on Medicaid and who receive federal food benefits.

Johnson took on those criticisms as well later that evening, while speaking at an event for the Tennessee Republican Party.

‘That’s real money for real people,’ Johnson said of the legislation. ‘Now, we can never forget. We never forget that every single Democrat in Congress – House and Senate – voted against every one of those big wins for the people. And we’ve got to remind the voters of that when the left lies about our bills.’

He accused Democrats of ‘lying’ about the legislation as their only political crutch.

‘How many of you know that’s all they got left? They don’t have a leader, no platform, no policies that are digestible by the American people. They just have to lie about what we’re doing,’ Johnson said.

‘Democrats voted against the prosperity and security of the American people. And they voted against working families’ tax cuts. It’s that simple, and they cannot escape it.’

Trump himself called the legislation ‘the largest working-class tax cuts in American history’ in comments to reporters ahead of a Cabinet meeting on Tuesday.

The bill passed the House and Senate just before GOP leaders’ self-imposed Fourth of July deadline, with Trump marking the holiday in a large signing ceremony.

But the Democratic opposition this August has been fierce.

In addition to holding events in their own constituencies, both House and Senate Democrats have traveled across the country criticizing the bill.

‘Just spoke with seniors in Martinsville about some of the fallout from Trump’s Big Ugly Bill,’ Sen. Mark Warner, D-Va., wrote on X of a recent event he held in his state. ‘When the impacts of this scam start, we’re all going to be stuck footing the bill with worse and more expensive health care.’