JERUSALEM— The Hashemite Kingdom of Jordan is under growing pressure to extradite the self-confessed female Hamas terrorist Ahlam Aref Ahmad al-Tamimi, who engineered the terrorist bombing at a Jerusalem pizzeria in 2001 that murdered three Americans among 16 people, half of whom were children.

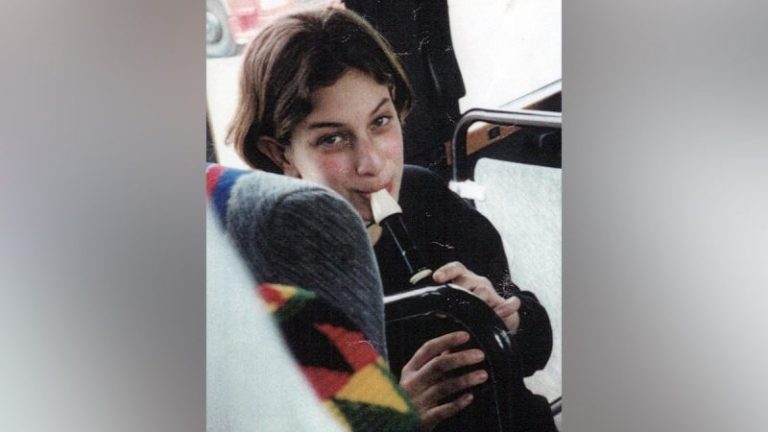

Frimet and Arnold Roth, the parents of Malki Roth, a 15-year-old U.S. citizen murdered in the 2001 Sbarro pizzeria bombing, held a virtual meeting on July 17, 2025 with Jeanine F. Pirro, United States Attorney for the District of Columbia.

The U.S. State Department has a $5 million reward for information leading to al-Tamimi’scapture, even as reports claim Jordan’s King Abdullah II has played hardball, refusing to extradite the accused mass murderer.

‘You have the capacity to push for her extradition, to ensure that the 1995 treaty is honored, to show Jordan and its population along with the watching world that harboring terrorists has consequences,’ Arnold Roth told Pirro during the meeting, according to a family press release following the meeting.

The 24th anniversary of the Aug. 9, 2001 bombing is next month.

Roth added, ‘We’re here today to implore you to act. Jordan needs to know the U.S. cannot tolerate the protection of a murderer of American citizens. U.S. justice needs to be respected by the world and, without hammering this point too hard, by America’s lawmakers and senior officials.’

The Roths said that the meeting focused on the need for ‘concrete steps’ to advance the long-delayed extradition of al-Tamimi.

Al-Tamimi’sterrorist bombing also killed Judith Shoshana Greenberg and Chana Nachenberg in the 2001 attack. ‘All the victims deserve justice,’ Arnold Roth said, stressing that Tamimi’s extradition should become a ‘true priority’ for the U.S. Department of Justice.

When asked if the extradition of al-Tamimi was raised by U.S. Secretary of State Marco Rubio in his Wednesday meeting with Jordanian Foreign Minister Ayman Safadi, a State Department spokesperson told Fox News Digital, ‘The United States has continually emphasized to the Government of Jordan the importance of holding Ahlam al-Tamimi, the convicted terrorist released by Israel in a 2011 prisoner swap, accountable in a U.S. court for her admitted role in a 2001 bombing in Jerusalem that killed 15 people, including Americans Malka Chana Roth, Judith Shoshana Greenbaum, and Chana Nachenberg. The United States continues to impress upon the Government of Jordan that Tamimi is a brutal murderer who should be brought to justice.’

The State Department referred Fox News Digital to the Department of Justice for more information about the U.S. criminal case against al-Tamimi.

The Justice Department and Pirro’s office did not immediately respond to Fox News Digital press queries.

Al-Tamimi is on the FBI’s Most Wanted Terrorists list. She is the second female to appear on the terrorism list.

Frimet Roth told U.S. Attorney Pirro that ‘We cannot carry this fight alone any longer. Judge Pirro, please, be the voice for Malki and the other American victims. Be the advocate for justice that has been denied for too long. We beg you to act—not for our sake alone, but for the integrity of American law and the sanctity of every life lost to terror.’

The Roths also delivered a petition to U.S. Ambassador to Israel Mike Huckabee in May 2025, with some 30,000 signatures urging the Trump administration to press Jordan for al-Tamimi’s extradition.

Arnold Roth told Fox News Digital that ‘No senior figure from State has ever, in all the years of our fight for justice, agreed to speak with us. Their treatment of us and of the Tamimi case is deplorable. Victoria Nuland, then one of the top-ranking figures in the State Department. Nuland wrote to us in the names of President Biden and then-Sec of State Antony Blinken, and told us that the Tamimi case was quote ‘a foremost priority’ for the U.S. And that they would keep us informed. She then [they] ignored every follow-up letter that I sent her, and of course so said Biden and Blinken.’

Jordan’s government is a major recipient of U.S. Foreign Military Financing (FMF).

According to a January 2025 U.S. State Department fact sheet, ‘Since 2015, the Department of State has provided Jordan with $2.155 billion in FMF, which makes Jordan the third-largest global recipient of FMF funds over that time period. In addition, the Department of Defense (DoD) has provided $327 million to the Jordanian Armed Forces (JAF) under its 333 authority since 2018, making Jordan one of the largest recipients of this funding.’

Al-Tamimi reportedly boasted about her terrorist operation in the Arab media and called for more terrorism against Israel. ‘Of course. I do not regret what happened. Absolutely not. This is the path. I dedicated myself to jihad for the sake of Allah, and Allah granted me success. You know how many casualties there were [in the 2001 attack on the Sbarro pizzeria]. This was made possible by Allah. Do you want me to denounce what I did? That’s out of the question. I would do it again today, and in the same manner,’ she said in 2011, according to a MEMRI translation.

In 2017, the U.S. Justice Department publicly announced that it had charged her with the Jerusalem suicide bombing.

Fox News Digital sent multiple press queries to Jordan’s government and its embassies in Washington, D.C., and Tel Aviv.

This post appeared first on FOX NEWS