Questcorp Mining Inc. (CSE: QQQ) (OTCQB: QQCMF) (FSE: D910) (the ‘Company’ or ‘Questcorp’) is pleased to update shareholders on the on-going surface exploration in preparation for drilling at the La Union Gold-Silver Project in Sonora, Mexico. Questcorp has an Option earn a 100% interest from Riverside Resources Inc. in the 2,520 ha (25 km sq) property by making a series of cash payments and share issuance and completing a series of exploration expenditures.

Questcorp President & CEO, Saf Dhillon, stated: ‘We are pleased with the progress Riverside has made as we complete the preliminary exploration steps, in finalizing our drill targets for the upcoming maiden drill program at La Union. The decades of in country exploration experience that John-Mark and his Riverside team diligently bring to focus at the La Union project is very evident as they continue to further de-risk the up-coming 1,500 metre drill program.’

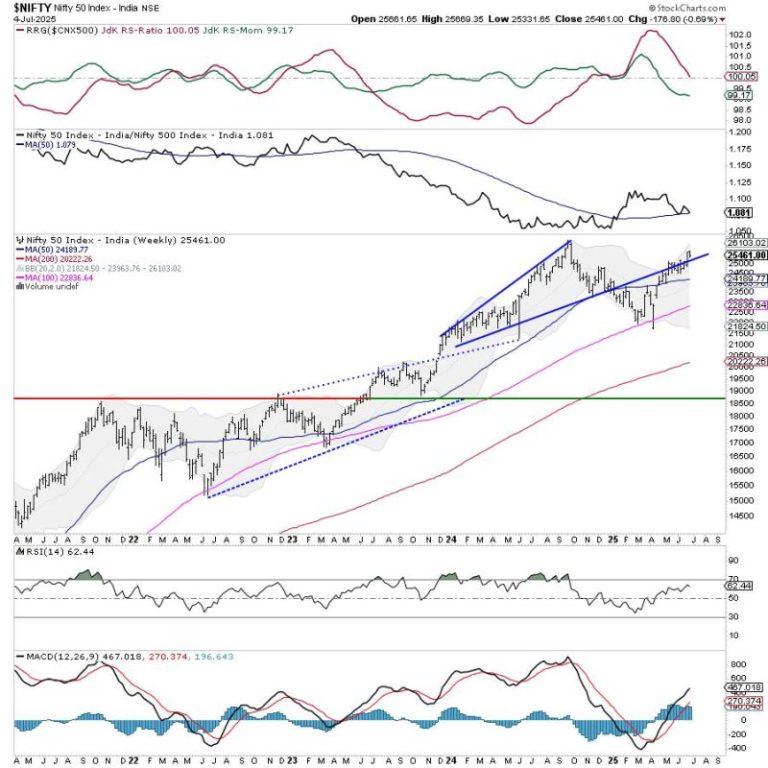

Figure 1: Cross section IP with interpreted structures and targets from Union new Induced Polarity geophysics survey.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10197/257897_4d60e7d2c4556af9_001full.jpg

La Union operator Riverside Resources has successfully completed two IP lines over the La Union and La Union Norte mines respectively, highlighting chargeability and resistivity features at depth which will guide the placement of the first ever drill holes on the property, as well as correlating with mapped mineralized zones and former workings.

A drone magnetic survey was flown over the property to provide structural context, follow up potential intrusive feeders and provide information about potential faults beneath the pediments and post-mineral young cover units.

Ongoing surface geochemistry and mapping continues to strengthen the targeting pipeline, particularly across exposed gold-rich manto zones and along the margins of shallow post-mineral gravel pediment cover. These efforts are focused on delineating the transition zones from covered to exposed mineralization and establishing structural controls that may influence ore continuity at depth.

The La Union Project

The La Union Project is a carbonate replacement deposit (‘CRD’) project hosted by Neoproterozoic sedimentary rocks (limestones, dolomites, and siliciclastic sediments) overlying crystalline Paleoproterozoic rocks of the Caborca Terrane. The structural setting features high-angle normal faults and low-to-medium-angle thrust faults that sometimes served as mineralization conduits. Mineralization occurs as polymetallic veins, replacement zones (mantos, chimneys), and shear zones with high-grade metal content, as shown in highlight grades of 59.4 grams per metric tonne (g/t) gold, 833 g/t silver, 11% zinc, 5.5% lead, 2.2% copper, along with significant hematite and manganese oxides, consistent with a CRD model (see the technical report entitled ‘NI 43-101 Technical Report on the Union Project, State of Sonora, Mexico’ dated effective May 6, 2025 available under Questcorp’s SEDAR+ profile). These targets also demonstrate intriguing potential for large gold discoveries potentially above an even larger porphyry Cu district potential as the Company’s target concept at this time.

Questcorp cautions investors grab samples are selective by nature and not necessarily indicative of similar mineralization on the property.

Riverside, the operator of the La Union Project, is currently lining up the various geophysical contractors to immediately undertake orientation surveys and follow up detailed survey to confirm and enhance the drill targets.

The technical and scientific information in this news release has been reviewed and approved by R. Tim Henneberry, P. Geo (BC), a director of the Company and a ‘qualified person’ under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Questcorp Mining Inc.

Questcorp Mining Inc. is engaged in the business of the acquisition and exploration of mineral properties in North America, with the objective of locating and developing economic precious and base metals properties of merit. The Company holds an option to acquire an undivided 100% interest in and to mineral claims totaling 1,168.09 hectares comprising the North Island Copper Property, on Vancouver Island, British Columbia, subject to a royalty obligation. The Company also holds an option to acquire an undivided 100% interest in and to mineral claims totaling 2,520.2 hectares comprising the La Union Project located in Sonora, Mexico, subject to a royalty obligation.

Contact Information

Questcorp Mining Corp.

Saf Dhillon, President & CEO

Email: saf@questcorpmining.ca

Telephone: (604) 484-3031

This news release includes certain ‘forward-looking statements’ under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to Riverside’s arrangements with geophysical contractors to undertake orientation surveys and follow up detailed survey to confirm and enhance the drill targets. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: the ability of Riverside to secure geophysical contractors to undertake orientation surveys and follow up detailed survey to confirm and enhance the drill targets as contemplated or at all, general business, economic, competitive, political and social uncertainties, uncertain capital markets; and delay or failure to receive board or regulatory approvals. There can be no assurance that the geophysical surveys will be completed as contemplated or at all and that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/257897

News Provided by Newsfile via QuoteMedia