Donald Trump entered 2025 pledging to end wars and reorient U.S. foreign policy around what he repeatedly described as ‘peace through strength.’

Throughout the year, Trump has cast his diplomacy as peace-focused, telling reporters, ‘We think we have a way of getting peace,’ and publicly arguing that his record merited a Nobel Peace Prize. The U.S. State Department echoed that framing in its year-end summary of diplomatic efforts, highlighting initiatives it said aimed to ‘secure peace around the world.’

By the close of 2025, several conflicts saw impressive diplomatic progress, while others were still experiencing issues after years of hatred and violence.

Gaza (Israel–Hamas)

The most consequential diplomatic development of the year came in early October, when the Trump administration helped broker a ceasefire framework between Israel and Hamas. The agreement halted large-scale fighting after months of intense combat and enabled the release of all remaining hostages from Hamas’ Oct. 7 attack on Israel, except for the body of Ron Gvili that remains held captive by Hamas terrorists.

The administration later cited the ceasefire as a central element of its 2025 diplomatic record. While the truce largely held through the end of the year, core issues including Gaza’s long-term governance, demilitarization and enforcement mechanisms remained unresolved, as well as rebuilding the enclave after the massive destruction and displacement. U.S. officials continued working with regional partners on next steps as fighting paused, as Israel’s Netanyahu is expected to meet with President Trump next week for talks on Gaza and other issues.

Armenia–Azerbaijan

In August, Trump hosted the leaders of Armenia and Azerbaijan at the White House for a U.S.-brokered peace declaration aimed at addressing decades of conflict tied to Nagorno-Karabakh. The agreement focused on transit routes, economic cooperation and regional connectivity and was promoted by the administration as a historic step.

While the historic declaration was signed, implementation and deeper reconciliation is still ongoing.

Ukraine–Russia war

Ukraine remained the most ambitious and elusive peace target of Trump’s 2025 agenda. The year opened with Trump insisting the war could be ended through direct U.S. engagement and leverage over both Kyiv and Moscow. Diplomacy intensified in August, when Trump hosted Russian President Vladimir Putin in Alaska, a summit framed by the White House as a test of whether personal diplomacy could unlock a settlement.

In parallel, Ukrainian President Volodymyr Zelenskyy was received at the White House, where Trump reiterated U.S. support for Ukraine while signaling that any peace would require difficult compromises. U.S. officials explored security guarantees and economic incentives, while avoiding public commitments on borders or NATO membership.

By December, talks accelerated. Ukraine entered new rounds of U.S.-led negotiations, and Trump told reporters the sides were ‘getting close to something.’ On Christmas Zelenskyy said talks with U.S. officials had produced a 20-point plan and accompanying documents that include security guarantees involving Ukraine, the United States and European partners. He acknowledged the framework was not flawless but described it as a tangible step forward. Zelenskyy is reportedly readying a visit to meet with President Trump, possibly as soon as Sunday.

Bloomberg reported that Russia views the 20-point plan agreed to between Ukraine and the U.S. as only a starting point. According to a person close to the Kremlin, Moscow intends to seek key changes, including additional restrictions on Ukraine’s military, arguing that the proposal lacks provisions important to Russia and leaves many questions unanswered.

Democratic Republic of Congo–Rwanda

In early December, Trump hosted the signing of the Washington Accords for Peace and Prosperity between the Democratic Republic of Congo and Rwanda. The agreement reaffirmed commitments to end decades of conflict and expand economic cooperation through a regional integration framework.

By the end of the year, Reuters and the Associated Press reported that armed groups remained active in eastern Congo, underscoring the fragility of the accord, though both sides seemed to be invested in a long-term peace.

India–Pakistan

After a terrorist attack in Kashmir and retaliatory strikes raised fears of escalation, U.S. officials engaged in emergency diplomacy. Trump announced a ceasefire between the two nuclear-armed rivals, with a potentially catastrophic escalation between the two nuclear powers avoided.

Cambodia–Thailand border dispute

On the sidelines of an ASEAN summit, Trump helped mediate a ceasefire between Cambodia and Thailand following months of border clashes.

Diplomatic efforts led by ASEAN and supported by external parties are ongoing, but fresh clashes and mutual recriminations between Thailand and Cambodia continue to challenge peace prospects and have led to large-scale displacement and civilian harm. Following the recent flare-ups, and with offers for mediation from Secretary of State Marco Rubio, a new ceasefire was agreed upon on Saturday to end weeks of fighting on the border.

Iran–Israel confrontation

Following U.S. and Israeli strikes on Iranian nuclear facilities, the Trump administration focused on containing escalation and reinforcing deterrence. No diplomatic agreement followed, but the confrontation did not expand into a broader regional war by year’s end.

Recently Israel warned that Iran might use its ballistic missile drills as a cover for a surprise attack.

Sudan

Sudan remained one of the world’s deadliest conflicts. U.S. diplomacy has focused primarily on efforts to halt fighting and expand humanitarian access rather than brokering a comprehensive peace.

In December, Saudi Arabia and the United States presented Sudanese army chief Abdel Fattah al-Burhan with a three-point proposal aimed at ending the war, facilitating aid delivery and transferring power to civilians, according to Sudan Tribune.

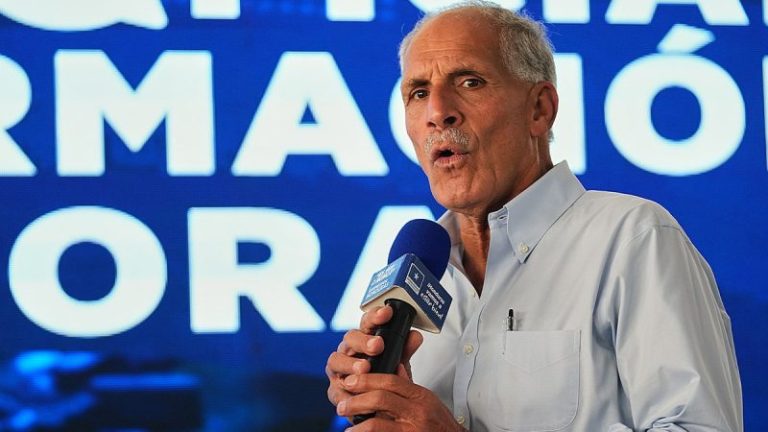

Venezuela

As the year closed, Venezuela emerged as the United States’ clearest point of direct confrontation. The administration framed its posture as an extension of its broader ‘peace through strength’ doctrine, even as the risk of escalation lingered.

While the White House pursued de-escalation and negotiated arrangements elsewhere, its approach toward Nicolás Maduro relied almost entirely on pressure, not talks. Trump continued to cast Maduro as a criminal threat tied to drug trafficking, accusing him of rejecting the results of Venezuela’s last election and stealing the presidency.

With no diplomatic channel open, the U.S. maintained sweeping sanctions and stepped up efforts against cartel networks linked to the regime. There was no peace process in sight — but some opposition figures and U.S. allies argued that sustained pressure could still force political change in 2026, and ultimately hasten the end of Maduro’s rule.

This post appeared first on FOX NEWS