The White House accused Democrats from the House Committee on Oversight and Government Reform of spreading a ‘cherry-picked’ and ‘false narrative’ Friday after they released another batch of photos from Jeffrey Epstein’s estate, this time featuring prominent figures including Donald Trump, Bill Clinton and Woody Allen.

The release comes about a week after the same group said it ‘received never-before-seen photos and videos of Jeffrey Epstein’s private island that are a harrowing look behind Epstein’s closed doors.’

‘Oversight Dems received 95,000 new photos from Jeffrey Epstein’s estate. These disturbing images raise even more questions about Epstein and his relationships with some of the most powerful men in the world. Time to end this White House cover-up. Release the files!’ Oversight Dems said Friday on X.

White House spokeswoman Abigail Jackson accused Democrats of ‘selectively releasing cherry-picked photos with random redactions to try and create a false narrative.’

‘Here’s the reality: Democrats like Stacey Plaskett and Hakeem Jeffries were soliciting money and meetings from Epstein AFTER he was a convicted sex offender,’ she added. ‘The Democrat hoax against President Trump has been repeatedly debunked, and the Trump administration has done more for Epstein’s victims than Democrats ever have by repeatedly calling for transparency, releasing thousands of pages of documents and calling for further investigations into Epstein’s Democrat friends.

‘It’s time for the media to stop regurgitating Democrat talking points and start asking Democrats why they wanted to hang around Epstein after he was convicted.’

House Minority Leader Hakeem Jeffries, D-N.Y., previously has fired back at accusations that he may have had dinner with Jeffrey Epstein or solicited donations from the disgraced financier. A House GOP effort to censure Plaskett also failed in mid-November.

A White House official also told Fox News Friday that the House Democrats selectively chose some of the photos to release, with random redactions intended for political purposes. None of the documents, the official added, have ever shown any wrongdoing by Trump.

Representatives for Clinton, Gates and Allen did not immediately respond Friday to requests for comment from Fox News Digital.

Other images released Friday included photos of sex toys.

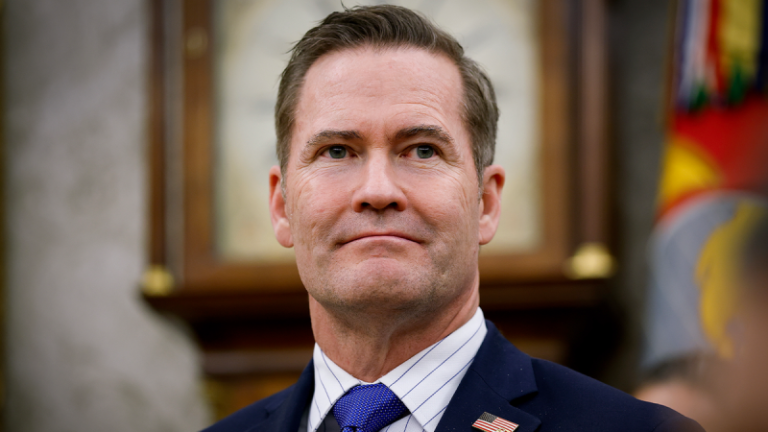

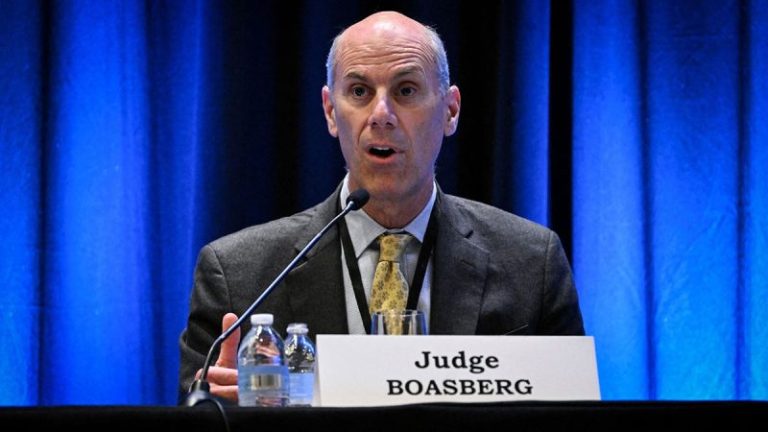

On Wednesday, a federal judge cleared the Justice Department to release secret grand jury transcripts from Epstein’s 2019 sex trafficking case.

U.S. District Judge Richard Berman reversed his earlier decision to keep the transcripts under wraps, citing Congress’ recent action on the Epstein files. Berman had previously warned that the contents of the roughly 70 pages of grand jury materials contain little new information.

That move came just one day after Judge Paul Engelmayer granted the DOJ’s motion to unseal separate grand jury transcripts and exhibits in Ghislaine Maxwell’s criminal case.

Fox News’ Kate Sprague, Anders Hagstrom, Diana Stancy, Emma Colton and Leo Briceno contributed to this report.