President Donald Trump spearheaded major changes to the Kennedy Center Honors ahead of the highly anticipated awards ceremony.

Founded in 1978, the Kennedy Center Honors recognize a handful of performing artists every year for their lifetime contributions to culture. The Kennedy Center Honors, which are presented by the John F. Kennedy Center for the Performing Arts in Washington, D.C., are considered the nation’s top lifetime achievement award for the performing arts.

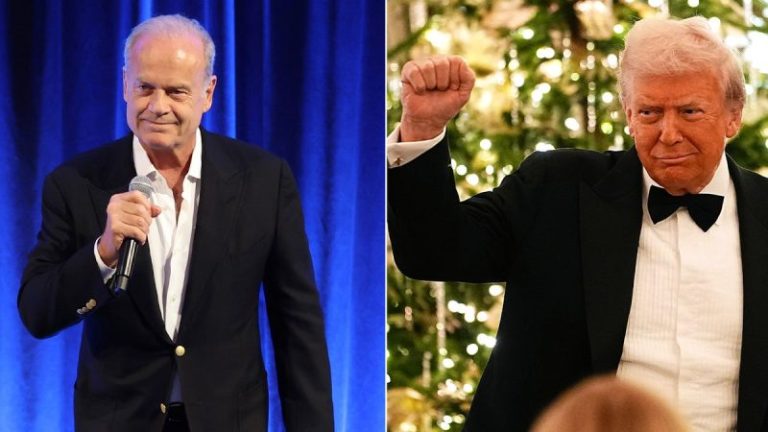

After returning to the White House in January, Trump, 79, became chairman of the Kennedy Center board and has since undertaken efforts to reshape the honors program — pushing for a glitzier, star-studded celebration.

In August, Trump announced this year’s lineup of honorees, which included country legend George Strait, Hollywood star Sylvester Stallone, rock band KISS, Broadway icon Michael Crawford and Grammy Award-winning singer Gloria Gaynor.

‘The 48th Kennedy Center Honorees are outstanding people, incredible, we can’t wait… in a few short months since I became chairman of the board, the Kennedy Center, we’ve completely reversed the decline of this cherished national institution,’ he said in his speech.

From overhauling the honoree selection process to unveiling a new medallion, here’s a breakdown of how the Kennedy Center Honors have been revamped under Trump.

Trump-led selection process

Since the Kennedy Honors’ inception, the honorees were chosen by a bipartisan committee that worked with the Kennedy Center’s artistic staff, the Board of Trustees, external arts advisors, and the Center’s president and Honors team.

While U.S. presidents have historically participated in the ceremonial aspects of the Honors including hosting a White House reception and attending the gala, they typically have not been directly involved in the selection process.

However, Trump said he played a major role in choosing the 2025 honorees during an August event at the Kennedy Center to announce the recipients.

Though there was a Special Honors Advisory Committee that made recommendations, Trump appeared to confirm that he made the final choices.

When reporters asked Trump how involved he was in selecting the 2025 honorees, he responded, ‘I was about 98% involved… they all came through me.’

‘I turned down plenty, they were too woke,’ he continued. ‘I had a couple of wokesters. No, we have great people. This is very different than it used to be.’

While taking aim at the state of Hollywood awards shows, Trump took a swipe at the Oscars.

‘Look at the Academy Awards — it gets lousy ratings now, it’s all woke,’ he said. ‘All they do is talk about how much they hate Trump, but nobody likes that. They don’t watch anymore…’

Trump concluded his ‘very long answer’ by saying he ‘was very involved’ in the selection of the Kennedy Center Honorees.

New medallion

For 47 years, the medallion received by the honorees had remained unchanged. The Honors medal hung from wide satin ribbon in five bright rainbow colors that formed a V-shape around the honoree’s neck.

The gold circular medallion was shaped like a starburst and featured an abstract representation of the Kennedy Center building and was handmade by the same family for nearly five decades. Throughout the awards show’s history, the medallions were handmade by the Baturin’s, a Washington D.C.- based family of artisans and metalworkers.

In a press release issued on Tuesday, the Kennedy Center announced that the medallions ‘have been re-imagined and donated by Tiffany & Co.’

‘As the first American high jewelry house, Tiffany & Co. has played a defining role in American luxury culture for nearly two centuries – making them the ideal collaborator to design the Honors medallion,’ the press release continued.

‘The brand-new medallion features a gold disc etched on one side with a depiction of the Kennedy Center. The building is flanked by rainbow colors representing the breadth of the arts celebrated when receiving the Honor. The reverse side bears the Honorees’ names in script above the date of the Medallion Ceremony, December 6, 2025. The medallion hangs from a navy-blue ribbon, a color associated with dignity and tradition.’

Massive governance shake-up ahead of the Honors

n February, Trump announced a major shakeup of the Kennedy Center leadership. He revealed that he had decided to immediately fire multiple Kennedy Center board members appointed by former President Joe Biden and other prior trustees, including the chairman, and fill that role himself.

Trump claimed he and the former chair David Rubenstein along with the ousted board members ‘do not share [the same] vision for a Golden Age in Arts and Culture,’ according to his announcement on Truth Social.

‘We will soon announce a new Board, with an amazing Chairman, DONALD J. TRUMP!’ he added.

Trump also criticized Kennedy Center programming, including drag shows, under the prior administration.

‘Just last year, the Kennedy Center featured Drag Shows specifically targeting our youth — THIS WILL STOP. The Kennedy Center is an American Jewel, and must reflect the brightest STARS on its stage from all across our Nation. For the Kennedy Center, THE BEST IS YET TO COME!’ Trump said on Truth Social.

He later replaced the former members with 14 other members, including allies including second lady Usha Vance and ‘God Bless the USA’ singer Lee Greenwood.

The new board elected Trump as chairman on Feb. 12. Trump dismissed long-serving Kennedy Center president Deborah Rutter and appointed his ally Ric Grenell – who became the U.S.’s first openly gay cabinet member under the first Trump administration when he served as acting director of national intelligence – as interim executive director amid the board overhaul.

More mainstream-pop culture class of nominees

The 2025 honorees including KISS, Gloria Gaynor, George Strait, Sylvester Stallone and Michael Crawford indicated a shift toward recognizing artists from more mainstream, pop culture fields rather than the cross-disciplinary lineups of prior years.

During the first two decades after the Honors were founded, the recipients were mainly from the world of classical arts with some notable exceptions including actor James Cagney, actress Lucille Ball and film director Elia Kazan.

In the mid-1990s, the Honors began expanding toward mainstream entertainment, honoring more pop musicians, rock artists, film and television actors and Broadway stars. The expansion accelerated through the 2000s and 2010s and into the 2020s.

In addition to mainstream artists, past honoree classes have always included representation from classical music, jazz, dance, opera or composition. However, 2025’s lineup features no honoree from those disciplines, marking a first in modern program history.

The 2025 honorees chosen under Trump’s direction are entirely from rock, disco, country, film and Broadway.

In the Kennedy Honors Center’s August press release announcing the honorees, Grenell said, ‘For nearly half a century, this tradition has celebrated those whose voices and visions tell our nation’s story and share it with the world.’ ‘This year’s Honorees have left an indelible mark on our history, reminding us that the arts are for everyone.’

Trump will host the Honors

At the August event to announce the honorees, Trump announced that he will host the Kennedy Center Honors gala, becoming the first president in history to host the event.

‘I’ve been asked to host. I said, I’m the President of the United States. Are you fools asking me to do that? ‘Sir, you’ll get much higher ratings.’ I said ‘I don’t care. I’m President of the United States, I won’t do it.’ They said, ‘Please,” Trump told reporters.

Trump went on to say that his Chief of Staff Susie Wiles also asked him to host the Honors.

‘I said, ‘OK, Susie, I’ll do it.’ That’s the power she’s got,’ he said. ‘So I have agreed to host. Do you believe what I have to do? And I didn’t want to do it, OK? They’re going to say, ‘He insisted.’ I did not insist, but I think it will be quite successful, actually.’

‘It’s been a long time. I used to host ‘The Apprentice’ finales and we did rather well with that,’ Trump added, referring to his long-running NBC reality competition show.

‘So I think we’re going to do very well, because we have some great honorees, some really great ones.’

During Trump’s first term, he and First Lady Melania Trump did not attend the Honors or host the traditional White House reception for the honorees.

In 2017, honorees including Norman Lear and dancer Carmen de Lavallade announced that they would not attend a White House reception hosted by Trump in protest.

The White House subsequently issued a statement that read: ‘The president and first lady have decided not to participate in this year’s activities to allow the honorees to celebrate without any political distraction.’

Trump and Melania also did not attend in 2018 and 2019. In 2020, the Honors were postponed due to the COVID-19 pandemic and instead took place in May 2021, with a revamped format including smaller, socially-distanced and virtual tributes.

The 48th Annual Kennedy Center Honors will take place on Dec. 7 at the Kennedy Center in Washington, D.C. and will air Dec. 23 on the CBS Television Network and on Paramount+

This post appeared first on FOX NEWS