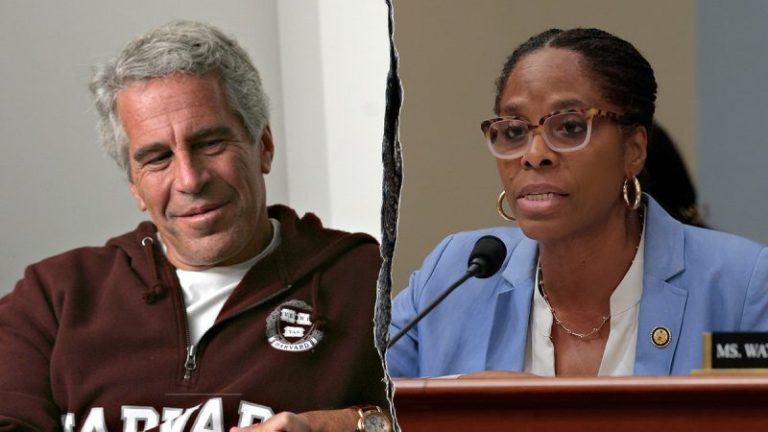

A House Freedom Caucus-led bid to strip a member of the House Democratic Caucus of her role on a high-profile committee after her ties to Jeffrey Epstein were revealed earlier this month failed on Tuesday night.

Lawmakers voted against censuring Del. Stacey Plaskett, D-V.I., the Virgin Islands’ nonvoting delegate in the House of Representatives, over newly surfaced text messages between her and Epstein that were exchanged during the February 2019 congressional testimony of Michael Cohen.

The censure had also included language to remove Plaskett from the House Permanent Select Committee on Intelligence, which oversees entities like the FBI and CIA and regularly receives classified briefings on matters of national security.

Three Republicans joined Democrats to kill the measure, while three more Republicans voted ‘present.’ It ultimately failed in a 209-214 vote.

The three Republicans who voted against censuring Plaskett were Reps. Lance Gooden, R-Texas, Don Bacon, R-Neb., and Dave Joyce, R-Ohio.

House Homeland Security Committee Chairman Andrew Garbarino, R-N.Y., voted ‘present’ along with Reps. Dan Meuser, R-Pa., and Jay Obernolte, R-Calif.

Rep. Ralph Norman, R-S.C., who introduced the resolution, said during debate on the measure on Tuesday, ‘The House of Representatives has a responsibility and a duty to protect the integrity of this institution. And what we learn from the documents released by Jeffrey Epstein’s estate is nothing short of alarming.’

‘Those documents show that Delegate Stacey Plaskett, a sitting member of Congress, coordinated her questioning during an Oversight — an official Oversight hearing, with a man who was a convicted sex offender, a man whose crimes against minors shocked this entire nation.’

Rep. Jamie Raskin, D-Md., who led Democrats’ rebuttal against the resolution, called the measure ‘one more pathetic effort to distract and divert attention from the fact that the president’s name appeared more than a thousand times already in the small fraction of material released on Epstein.’

He also repeatedly referred to Epstein as Plaskett’s ‘constituent’ over his primary residence having been in the Virgin Islands.

Texts exchanged during the 2019 hearing, in which Cohen accused President Donald Trump of a scheme to pay off mistresses to hide evidence of extramarital affairs during his 2016 presidential bid, show Epstein taking a heavy interest in Plaskett’s questioning.

Epstein appeared to guide Plaskett’s lines of questioning at times. One text showed him saying, ‘Hes opened the door to questions re who are the other henchmen at trump org.’

Plaskett was shown to respond, ‘Yup. Very aware and waiting my turn.’

Republicans have seized on Plaskett’s messages with Epstein as proof of a double standard by Democrats on the late pedophile financier’s case.

House Democrats have been arguing for transparency in pushing to uncover any potential improper links between Trump and Epstein but have been largely silent on Plaskett in the days since her ties to him surfaced.

Neither Plaskett nor Trump has been accused of any wrongdoing connected to Epstein’s crimes, however.

Raskin accused Republicans on Tuesday of robbing Plaskett of her right to due process.

‘Without even going to the Ethics Committee, much less a court, they want to arraign her on some charges based on a newspaper article, that she did something lawful — however ill-advised — it may have been. She took a phone call from one of her constituents,’ Raskin said.

‘Where is the ethical transgression? Where is the legal transgression? Are you saying anybody on your side of the aisle who had a phone call with Jeffrey Epstein should be censured?’

Plaskett’s texts with Epstein were reported in a number of media outlets, but they were first found in a tranche of documents from Epstein’s estate and handed over to the House Oversight Committee.

‘I got a text from Jeffrey Epstein, who, at the time was my constituent — who was not public knowledge at that time, that he was under federal investigation — and who was sharing information with me,’ she said in her own defense on Tuesday.

Plaskett also pointed out her years of experience as a prosecutor when arguing she was not seeking advice on her line of questioning.

It’s worth noting, however, that while the federal probe into Epstein was not public knowledge, he first faced charges related to the exploitation of underaged girls as early as 2006.

The vote comes after a Democrat-led bid to refer Plaskett’s case to the House Ethics Committee, rather than moving forward with the censure resolution, failed to pass in a narrow 213-214 vote.

The House of Representatives had earlier moved to force the Department of Justice (DOJ) to release all of its unclassified Epstein files in an overwhelming 427-1 vote.